Tax Austria Tipps

Der Begriff des faktischen Geschäftsführers ist nicht definiert, wurde aber durch die Rechtsprechung herausgearbeitet. Er kommt daher, dass dem formell…

Ende 2023 wurde vom Nationalrat das Start-Up-Förderungsgesetz beschlossen. Mit diesem Gesetz wurde eine Begünstigung für die Beteiligung von Dienstnehmern speziell…

Der Nationalrat hat große Teile des von der Regierung vorgestellten Bau- und Wohnpakets beschlossen. Ziel des Pakets ist eine Förderung…

Mit 1.1.2024 wurde nicht nur die Flexible Kapitalgesellschaft als neue Form der Kapitalgesellschaft eingeführt, sondern auch Änderungen am Mindeststammkapital der…

E-Commerce Starterpaket

Das Geschäftsmodell des Online-Handels hat sich als nachhaltiges Erfolgskonzept erwiesen. Für Sie als Online-Händler ist es essentiell, die steuerrechtlich relevanten Punkte zu Ihrem Vorteil zu nutzen!

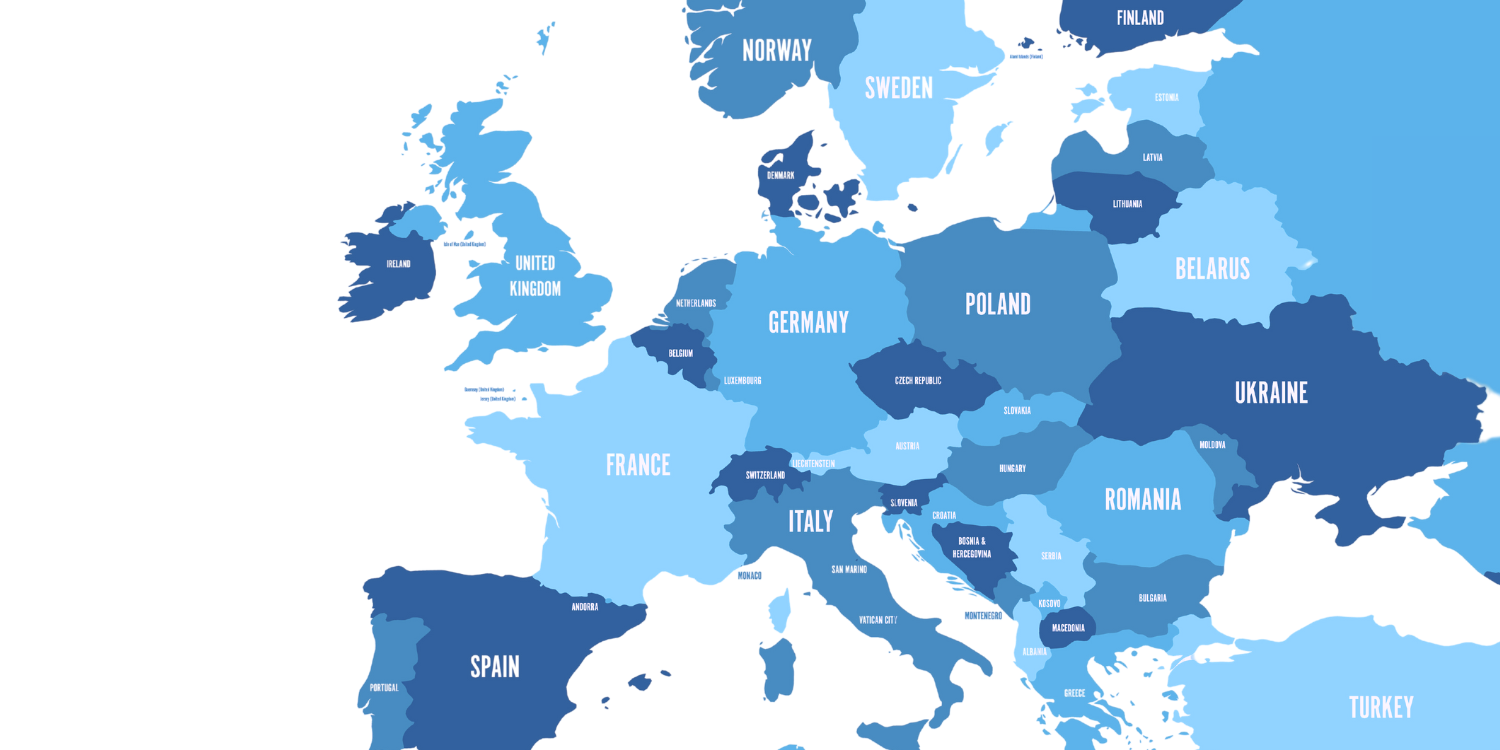

UMSATZSTEUER

& FISKALVERTRETUNG

Für ausländische Unternehmen insbesondere aus Nicht-EU-Ländern.

Wir haben langjährigeErfahrung!

IMMOBILIEN

& IMMOEST

Sie verkaufen, schenken oder erben gerade eine Immobilie und wollen über die steuerlichen Folgen Bescheid wissen?

ENTSENDUNG

& EXPATRIATES

Entsendung von Mitarbeitern – rechtskonform im Sinne von Arbeits- , Sozialrecht und Steuerrecht

News

Arztpraxis als Liebhaberei?

Das Bundesfinanzgericht (BFG) hatte im Rahmen einer Liebhabereiprüfung die Frage zu klären, ob es sich beim Führen einer Arztpraxis und der Tätigkeit für den Ärztefunkdienst um einen einheitlichen Betrieb handelte.Im…

Kleinunternehmerpauschalierung

Es ist für die Kleinunternehmerpauschalierung unschädlich, wenn die umsatzsteuerliche Kleinunternehmerbefreiung deswegen nicht anwendbar ist, weil ihr eine speziellere unechte Umsatzsteuerbefreiung vorgeht.Kleinunternehmer können seit der Veranlagung 2020 im Rahmen der Einnahmen-Ausgaben-Rechnung…

Regelbesteuerung der Land- und Forstwirte

Das Bundesministerium für Finanzen (BMF) hatte im Zuge einer Anfrage betreffend umsatzsteuerrechtlicher Fragen i.Z.m. der Regelbesteuerung der Land- und Forstwirte eine Auskunft erlassen. Darin legt es seine Rechtsansicht dar und…