We are pleased to assist you

at all activities for tax authority, social security and all other authorities. Advice in all tax matters, in all questions regarding Labour Law and Social Security and in many other business relating questions – analysing your business activities regarding optimal taxation – Consulting at strategic decisions.

Our Services

YOU ARE LOOKING FOR A TAX EXPERT?

We are able to assist you with Arrange an →…

SPECIALS FOR START UPS

Your are starting enterpreneurship. We assist you with Arrange an →…

PLASTIC TAX IN AUSTRIA AND CONSEQUENCES FOR ONLINE RETAILERS AND MARKETPLACES

In Austria there is no plastic tax yet (July…

FISCAL REPRESENTATIVE

Non-resident companies outside EU need for some taxes and contributions…

VAT REFUND FOR NON-RESIDENT COMPANIES

You are a company without a fixed establishment in Austria…

Guide to the VAT Mini One Stop Shop (MOSS)

This guide aims at providing a better understanding of the…

ACCOUNTING & ANNUAL REPORTS

You want to outsource your book keeping? We are pleased…

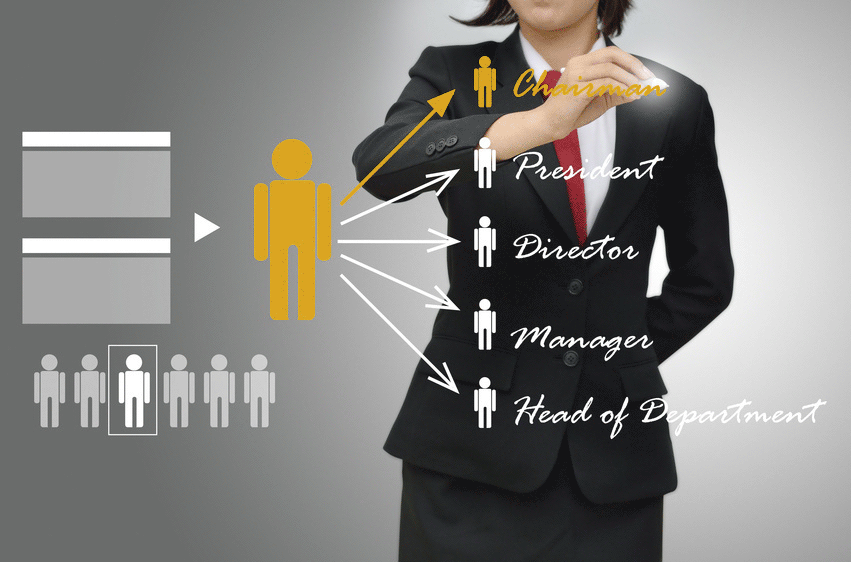

SALARY COMPUTATION – HUMAN RESOURCE MANAGEMENT

You do not want to be an expert in Labour…