Tax Austria Tipps

Für die Spendenbegünstigung von Vereinen sind formelle Voraussetzungen zu erfüllen, insbesondere ist eine bereits bestehende Spendenbegünstigung jährlich zu verlängern.

Grundstücke können durch Aufnahme in die Bilanz in das gewillkürte Betriebsvermögen aufgenommen werden, wenn dies dem Betrieb förderlich ist.

Wird ein Dienstverhältnis durch den Arbeitnehmer beendet, so kann er zur Leistung eines Ausbildungskostenrückersatzes verpflichtet werden. Dieser Kostenrückersatz muss nicht…

Ein Urlaub entbindet nicht von der Pflicht, für eine ordnungsgemäße Vertretung und eine Fristenkontrolle zu sorgen.

E-Commerce Starterpaket

Das Geschäftsmodell des Online-Handels hat sich als nachhaltiges Erfolgskonzept erwiesen. Für Sie als Online-Händler ist es essentiell, die steuerrechtlich relevanten Punkte zu Ihrem Vorteil zu nutzen!

UMSATZSTEUER

& FISKALVERTRETUNG

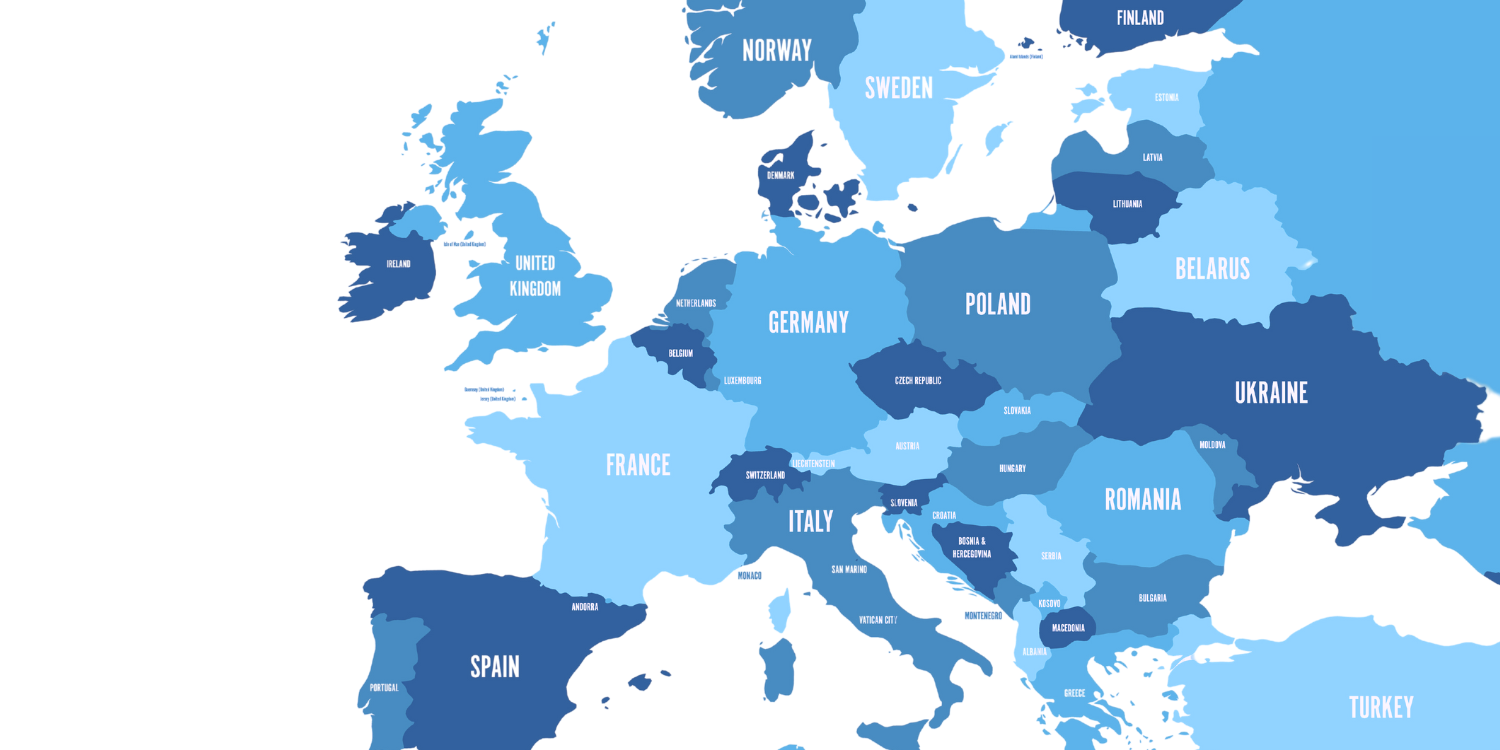

Für ausländische Unternehmen insbesondere aus Nicht-EU-Ländern.

Wir haben langjährige Erfahrung!

IMMOBILIEN

& IMMOEST

Sie verkaufen, schenken oder erben gerade eine Immobilie und wollen über die steuerlichen Folgen Bescheid wissen?

ENTSENDUNG

& EXPATRIATES

Entsendung von Mitarbeitern – rechtskonform im Sinne von Arbeits- , Sozialrecht und Steuerrecht

News

Jahresboni, Rabatte & Co

Insbesondere im Handelsbereich sind Jahresboni, Rabatte und andere Preisnachlässe gängige…

Änderungen in der Grunderwerbsteuer – Einführung Umwidmungszuschlag

Der Nationalrat hat die Ausweitung der Grunderwerbsteuerpflicht und die Einführung…

NoVA-Befreiung für leichte Nutzfahrzeuge

Im Zuge des Entlastungspakets für Klein- u. Mittelbetriebe wurde vom…

Neue „Weiterbildungszeit“

Im Ministerrat wurden die Eckpunkte der „Weiterbildungszeit“ vorgestellt, die ab…