Tax Austria Tipps

Die Wirtschaftskammer Österreich teilte mit, dass die im Jahr 2024 bekannt gegebenen Hebesätze und Schwellenwerte auch für 2026 unverändert gelten.…

Bis Ende Februar 2026 müssen Körperschaften bzw. Vereine die im Jahr 2025 ausbezahlten Freiwilligenpauschalen und einen bestimmten Betrag übersteigende Auszahlungen…

Der Verwaltungsgerichtshof (VwGH) stellte klar, dass das Abzugsverbot für das Entgelt von Arbeits- oder Werkleistungen, soweit sie den Betrag von…

Seit 1.1.2026 gelten neue Regelungen für freie Dienstnehmer. Dazu zählen gesetzlich festgelegte Kündigungsfristen und -termine, die Möglichkeit der Einbeziehung freier…

E-Commerce Starterpaket

Das Geschäftsmodell des Online-Handels hat sich als nachhaltiges Erfolgskonzept erwiesen. Für Sie als Online-Händler ist es essentiell, die steuerrechtlich relevanten Punkte zu Ihrem Vorteil zu nutzen!

UMSATZSTEUER

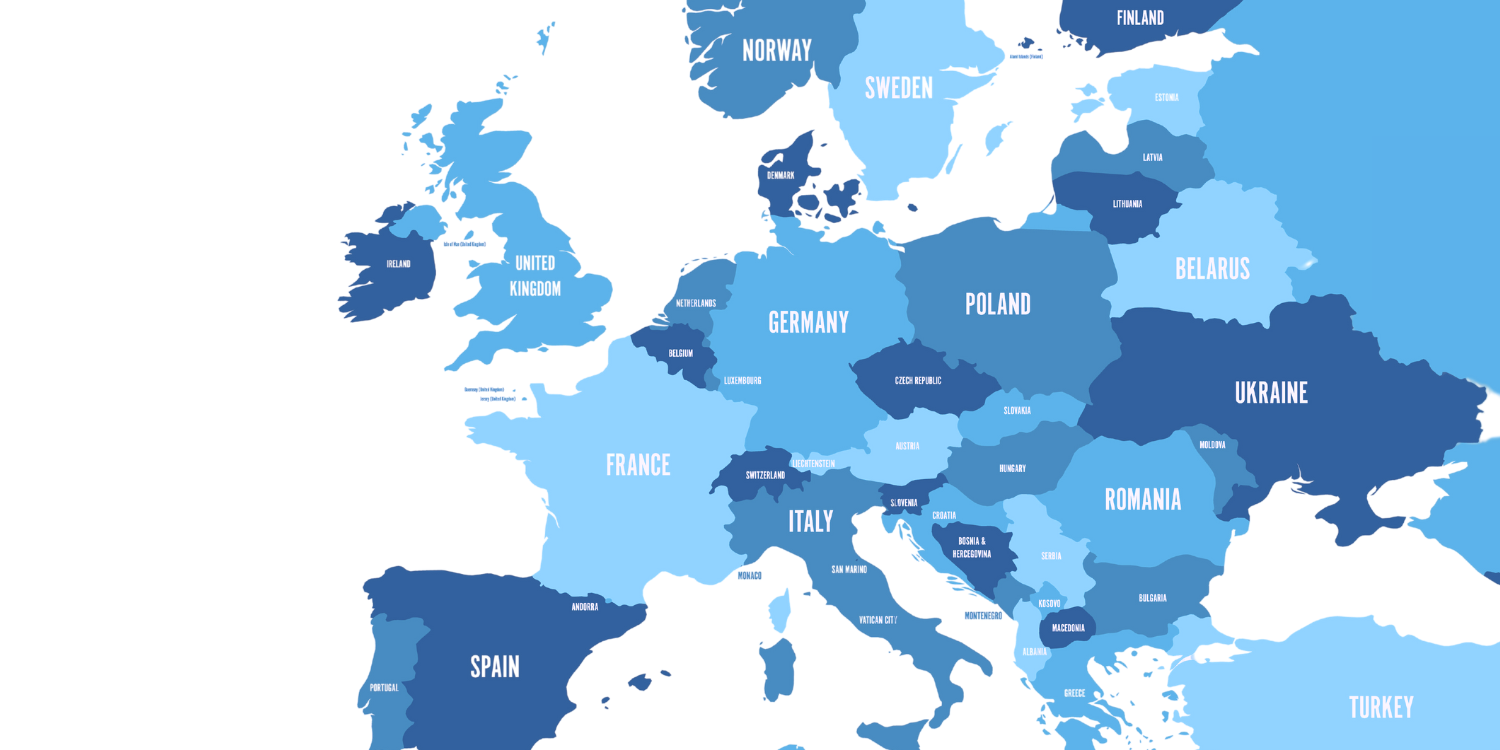

& FISKALVERTRETUNG

Für ausländische Unternehmen insbesondere aus Nicht-EU-Ländern.

Wir haben langjährige Erfahrung!

IMMOBILIEN

& IMMOEST

Sie verkaufen, schenken oder erben gerade eine Immobilie und wollen über die steuerlichen Folgen Bescheid wissen?

ENTSENDUNG

& EXPATRIATES

Entsendung von Mitarbeitern – rechtskonform im Sinne von Arbeits- , Sozialrecht und Steuerrecht

News

Differenzbesteuerung bei Wirtschaftsgütern aus gebrauchten Teilen

Erwirbt ein Unternehmer einen gebrauchten Gegenstand ohne Vorsteuerabzug von Privaten,…

Kursverluste aus Fremdwährungskredit

Der Verwaltungsgerichtshof (VwGH) stellt klar, dass Verluste aus Wechselkursschwankungen eines…

Elektronische Zustellung von Bescheiden

Eine fehlende E-Mail-Benachrichtigung über einen neu eingelangten Bescheid in der…

Vereinfachungsregel für Dreiecksgeschäfte

Der Verwaltungsgerichtshof (VwGH) hat zur Frage, ob die Vereinfachungsregel für…