Tax Austria Tipps

Der EU-One-Stop-Shop (EU-OSS) soll den grenzüberschreitenden Handel steuerlich vereinfachen. Das System wurde aber zu einer umsatzsteuerlichen Herausforderung.

Die Bundesregierung hat eine Senkung der Mehrwertsteuer auf Lebensmittel angekündigt. Ab 1.7.2026 wird die Mehrwertsteuer auf zentrale Produkte des täglichen…

Die steuerliche Behandlung von Kraftfahrzeugen im Unternehmensbereich hängt wesentlich vom Umfang der betrieblichen Nutzung sowie von der ordnungsgemäßen Dokumentation der…

Damit sich Mehrarbeit wieder lohnt, gelten seit 1.1.2026 neue steuerliche Regelungen für Überstundenzuschläge und das Feiertagsarbeitsentgelt.

E-Commerce Starterpaket

Das Geschäftsmodell des Online-Handels hat sich als nachhaltiges Erfolgskonzept erwiesen. Für Sie als Online-Händler ist es essentiell, die steuerrechtlich relevanten Punkte zu Ihrem Vorteil zu nutzen!

UMSATZSTEUER

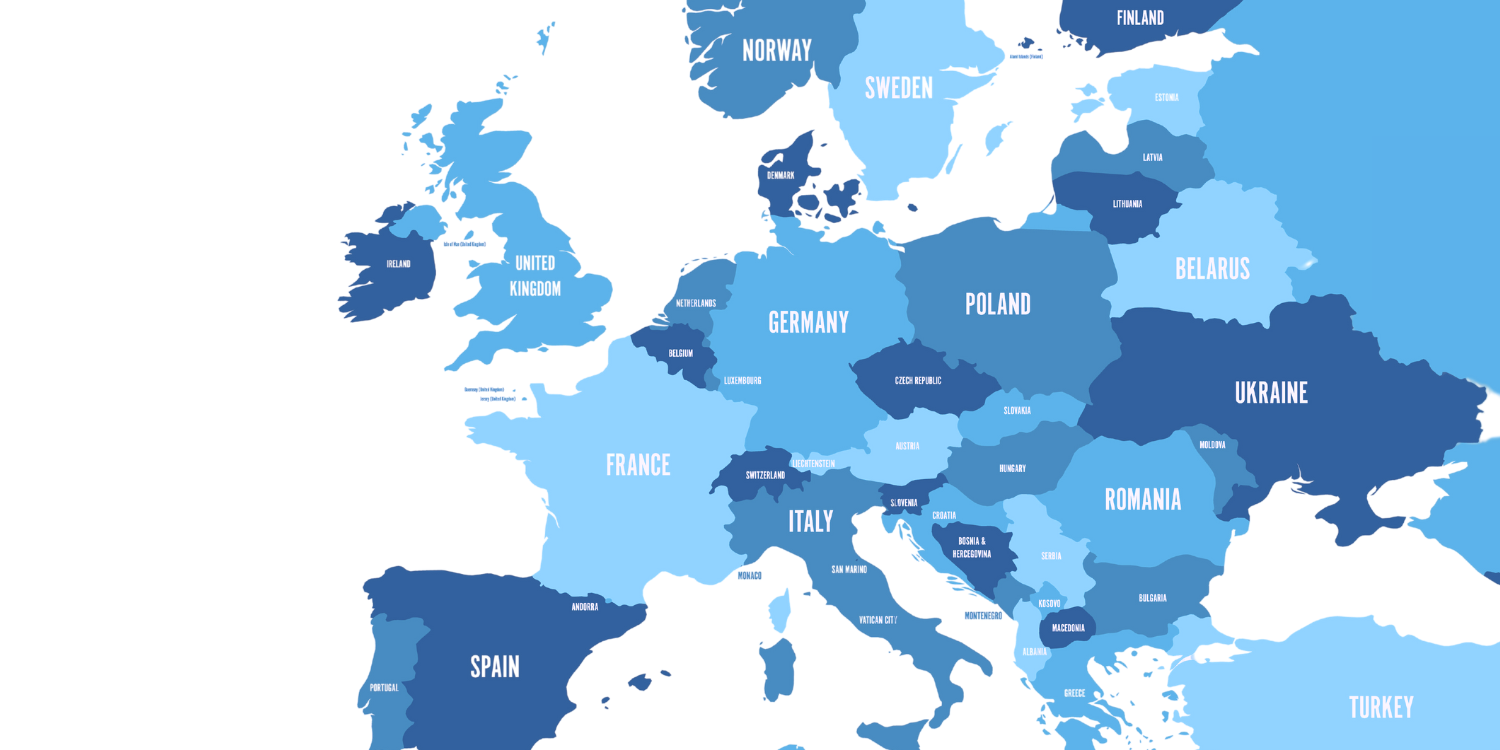

& FISKALVERTRETUNG

Für ausländische Unternehmen insbesondere aus Nicht-EU-Ländern.

Wir haben langjährige Erfahrung!

IMMOBILIEN

& IMMOEST

Sie verkaufen, schenken oder erben gerade eine Immobilie und wollen über die steuerlichen Folgen Bescheid wissen?

ENTSENDUNG

& EXPATRIATES

Entsendung von Mitarbeitern – rechtskonform im Sinne von Arbeits- , Sozialrecht und Steuerrecht

News

Kammerumlagen und Hebesätze ab 1.1.2026

Die Wirtschaftskammer Österreich teilte mit, dass die im Jahr 2024…

Freiwilligenpauschale: Meldepflicht von Vereinen

Bis Ende Februar 2026 müssen Körperschaften bzw. Vereine die im…

Forschungsprämie: Abzugsverbot für Managergehälter nicht anwendbar

Der Verwaltungsgerichtshof (VwGH) stellte klar, dass das Abzugsverbot für das…

Neue Regelungen für freie Dienstnehmer

Seit 1.1.2026 gelten neue Regelungen für freie Dienstnehmer. Dazu zählen…