Tax Austria Tipps

Mit 1.1.2026 traten mehrere Erleichterungen bei der Registrierkassen- und Belegerteilungspflicht in Kraft. Ziel ist die Entlastung von kleinen Betrieben.

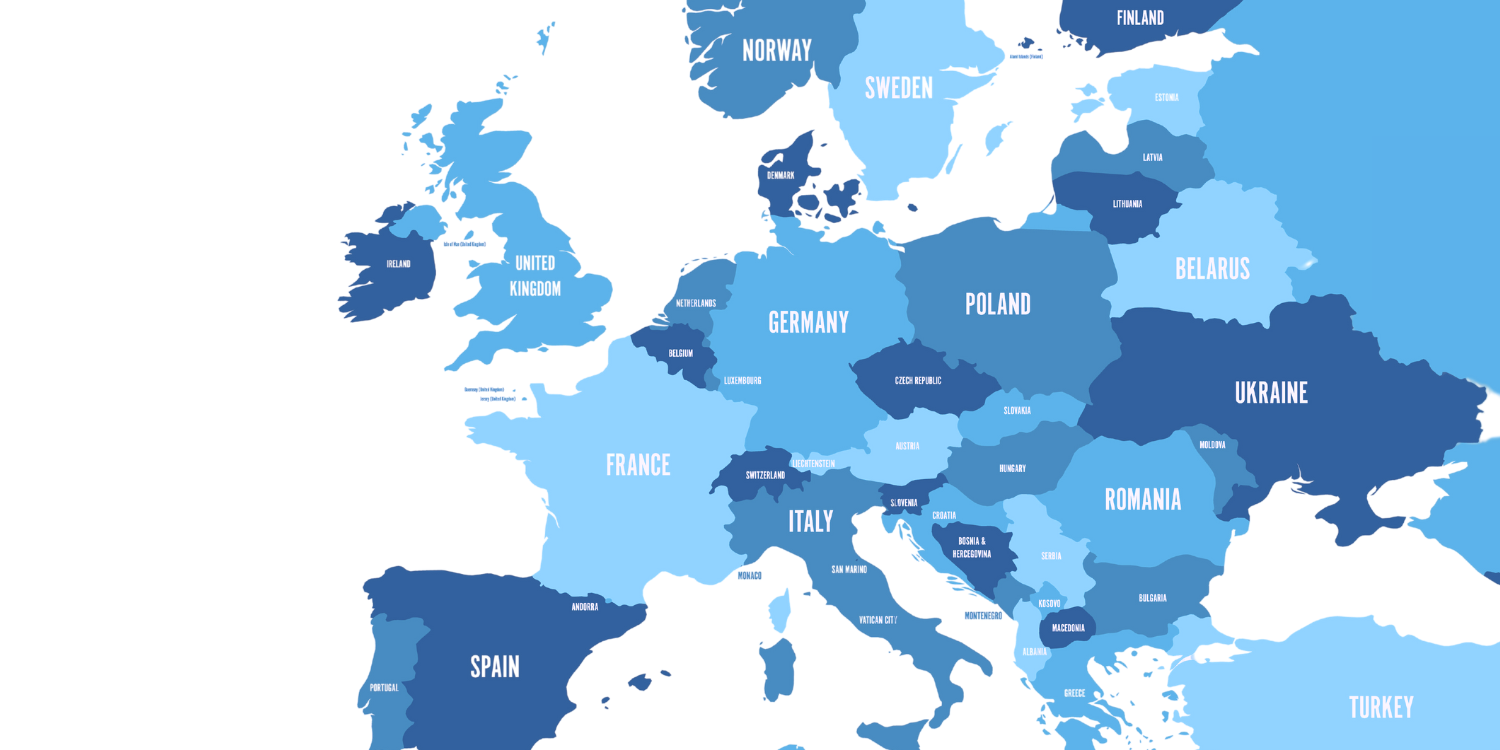

Mit der Verlagerung von Arbeitsplätzen in private Räume stellt sich die Frage nach den steuerlichen Folgen. Um bei grenzüberschreitenden Sachverhalten…

Mit der aktuellen Novelle der Forschungsprämienverordnung (FoPV) hat das Finanzministerium auf eine Entscheidung des Verwaltungsgerichtshofes (VwGH) reagiert.

2026 sind bei der Vermietung von Grundstücken Wahlrechte beim Ansatz der Abschreibungsbasis vorgesehen, die sich langfristig auch auf Veräußerungen auswirken…

E-Commerce Starterpaket

Das Geschäftsmodell des Online-Handels hat sich als nachhaltiges Erfolgskonzept erwiesen. Für Sie als Online-Händler ist es essentiell, die steuerrechtlich relevanten Punkte zu Ihrem Vorteil zu nutzen!

UMSATZSTEUER

& FISKALVERTRETUNG

Für ausländische Unternehmen insbesondere aus Nicht-EU-Ländern.

Wir haben langjährige Erfahrung!

IMMOBILIEN

& IMMOEST

Sie verkaufen, schenken oder erben gerade eine Immobilie und wollen über die steuerlichen Folgen Bescheid wissen?

ENTSENDUNG

& EXPATRIATES

Entsendung von Mitarbeitern – rechtskonform im Sinne von Arbeits- , Sozialrecht und Steuerrecht

News

Mehrwertsteuersenkung auf Lebensmittel

Die Bundesregierung hat eine Senkung der Mehrwertsteuer auf Lebensmittel angekündigt.…

Kilometergeld und Fahrtenbuch

Die steuerliche Behandlung von Kraftfahrzeugen im Unternehmensbereich hängt wesentlich vom…

Feiertagsarbeitsentgelt und Überstundenzuschläge

Damit sich Mehrarbeit wieder lohnt, gelten seit 1.1.2026 neue steuerliche…

Kammerumlagen und Hebesätze ab 1.1.2026

Die Wirtschaftskammer Österreich teilte mit, dass die im Jahr 2024…